by: Vicki Yamasaki, founder and chair, Corpus Christi for Unity and Peace Contact: CUP@corpuschristiforunityandpeace.org

CUP UPDATE: In consultation with a 501(c)(3) attorney, CUP has been informed that it’s unlikely the IRS will exclude migration grant revenue from includable public support, as challenged under the Public Support Test (section 501(a)(9)(2)).

CUP’s investigation will unveil a systemic issue stemming from inadequate financial oversight, raising the question of who truly governs the Catholic Church in America: the bishops or the government. At the pinnacle is the US Conference of Catholic Bishops (USCCB), which has amassed billions of dollars from the government, making these funds a significant portion of their revenue. The USCCB then distributes millions of government funds to Catholic Charities and other Catholic NGOs, thereby wielding substantial influence over these organizations. But who is ultimately in the driver’s seat? The government. As Aristotle aptly put it, “The man who has the purse strings rules the house.”

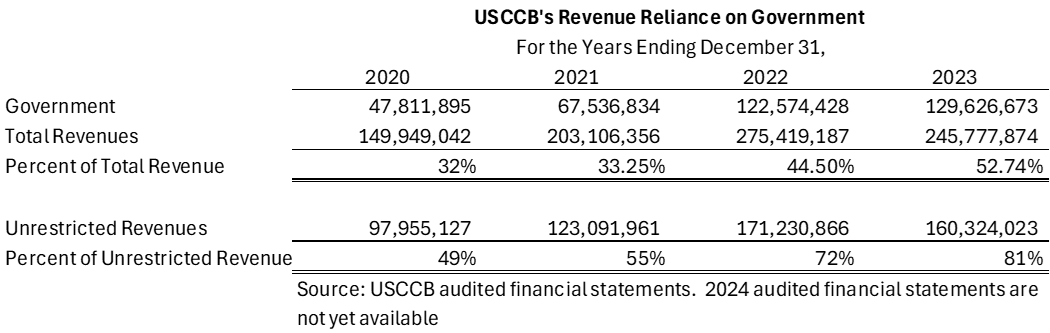

Majority of USCCB Revenues From the Government

In the past week, CUP verified that, according to the latest available financial reporting information for 2023, the USCCB received more than 50% of its total revenues from the U.S. government, and over 80% of its unrestricted revenues:

When the USCCB relies this heavily on government funding for a long period of time, several potential dangers arise:

- Loss of Independence: The Church becomes overly dependent on government funds, which compromises its independence and ability to make decisions based on its core values and mission.

- Government Influence: The government exerts influence over the Church’s activities, policies, and programs, potentially leading to conflicts with the Church’s mission of preserving the Deposit of the Faith.

- Public Perception: The faithful rightly perceive the Church as being too closely aligned with the government, which affects its credibility and trustworthiness as independent.

- Regulatory Compliance: Increased government funding comes with additional regulatory requirements and oversight, which redirects the bishops’ attention to burdensome activities having nothing to do with the mission of the Catholic Church.

- Mission Drift: The Church shifts its focus from its original mission and primary objectives to align more with government priorities and funding opportunities, leading to a dilution of its purpose.

Does The USCCB Deserve To Maintain Its Tax Exempt Status?

I am a CPA so my brain gravitates toward financial auditing and IRS rules. Naturally, the geek side of me wishes to point out that the USCCB has FAILED the 501c3 public support test requirement (to maintain the public charity status).

This test ensures that a nonprofit organization receives a substantial portion (at least 67%) of its support from the general public, governmental units, or other public charities, rather than a few large donors or any single source (defined as one that single-handedly contributes 5% or more of the not for profit’s revenue).

So what does this mean in simple terms? If the USCCB received from the government (a single source) more than 33% cumulatively over a three-year period, it fails the public charity test. By requiring that at least 67% of its support comes from a variety of sources, the IRS ensures that the organization is genuinely supported by a broad base of donors/sources, which aligns with the public charity mission. The IRS essentially frowns upon a not-for-profit becoming overly reliant on one source of income as the objective is to remain independent.

When performing the 33% public support test over the required 3-year period, the test requires inclusion of any single source that contributes 5% or more of the organization’s total support, whether that source is an individual donor, a business, or a governmental unit, including contributions from the U.S. government. The USCCB would have to ADD UP the revenues from every single ‘significant’ source (i.e., those > 5% of revenues).

Since the USCCB received more than 44% of its total revenue from the U.S. government from 2021-2023 (data for 2024 unavailable), it clearly fails the 33% public support test.

This simple rapid test is without looking to see if the USCCB had any other ‘significant’ source to include in the public support test.

Because the USCCB has failed the mandated IRS public support test, it risks being reclassified as a private foundation rather than a public charity. Private foundations face stricter regulations, including higher excise taxes on net investment income and more restrictive rules on self-dealing and lobbying activities.

What does this mean for parishioners wishing to donate to the USCCB? The limits for tax deductions are lower for contributions to private foundations. For cash donations, the deduction limit is typically 30% of the donor’s adjusted gross income (AGI) for private foundations, compared to 60% for public charities. For donations of appreciated securities, the limit is generally 20% of AGI for private foundations, compared to 30% for public charities.

CUP must ask: what kind of governance is being exercised by the bishops? Are they aware they are jeopardizing the public charity status of the USCCB? Do they deserve to maintain this status since they are operating essentially as a governmental unit?

How the Money Flows

In our first article, CUP highlighted the substantial amount of money flowing from the government to the USCCB and Catholic Charities. It’s evident that protecting their position on immigration is crucial for them, given the billions at stake.

Last week, we reported that since 2008, the USCCB and Catholic Charities have collected nearly half a billion dollars for transferring unaccompanied migrant children. Alarmingly, the U.S. government has been unable to locate 300,000 of these children who crossed the border during the Biden administration, leaving their wellbeing in question.

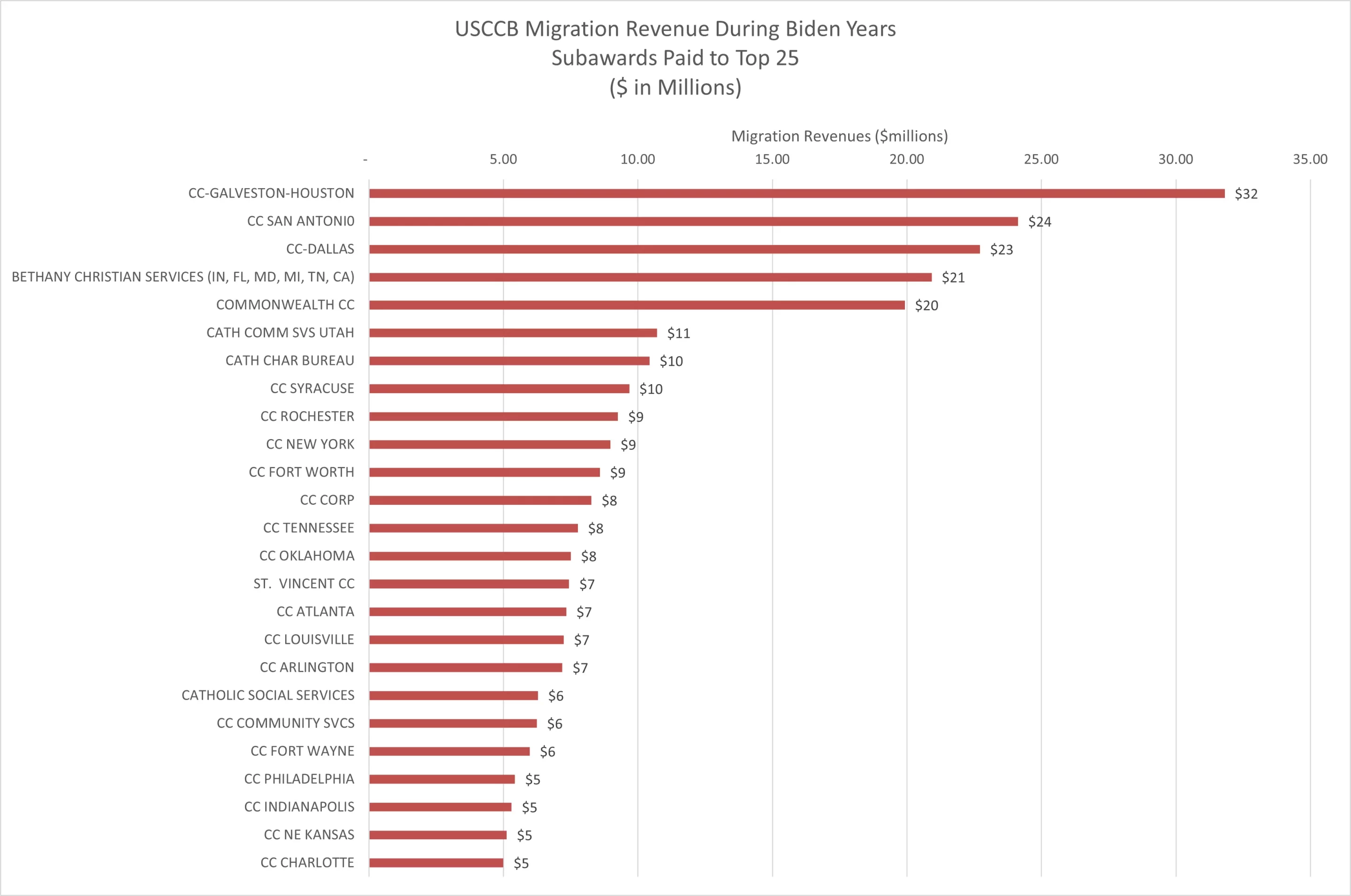

We now have a detailed breakdown of immigration-related funds paid to sub-grantees by the USCCB during the Biden years and from 2008 to the present. This information may surprise those who believed their local Catholic Charities affiliate was uninvolved in the human trafficking money flow.

Click here to view all subgrantees receiving USCCB migration revenues during the Biden Years. There was a total of $369 million paid to sub-grantees during the Biden years.

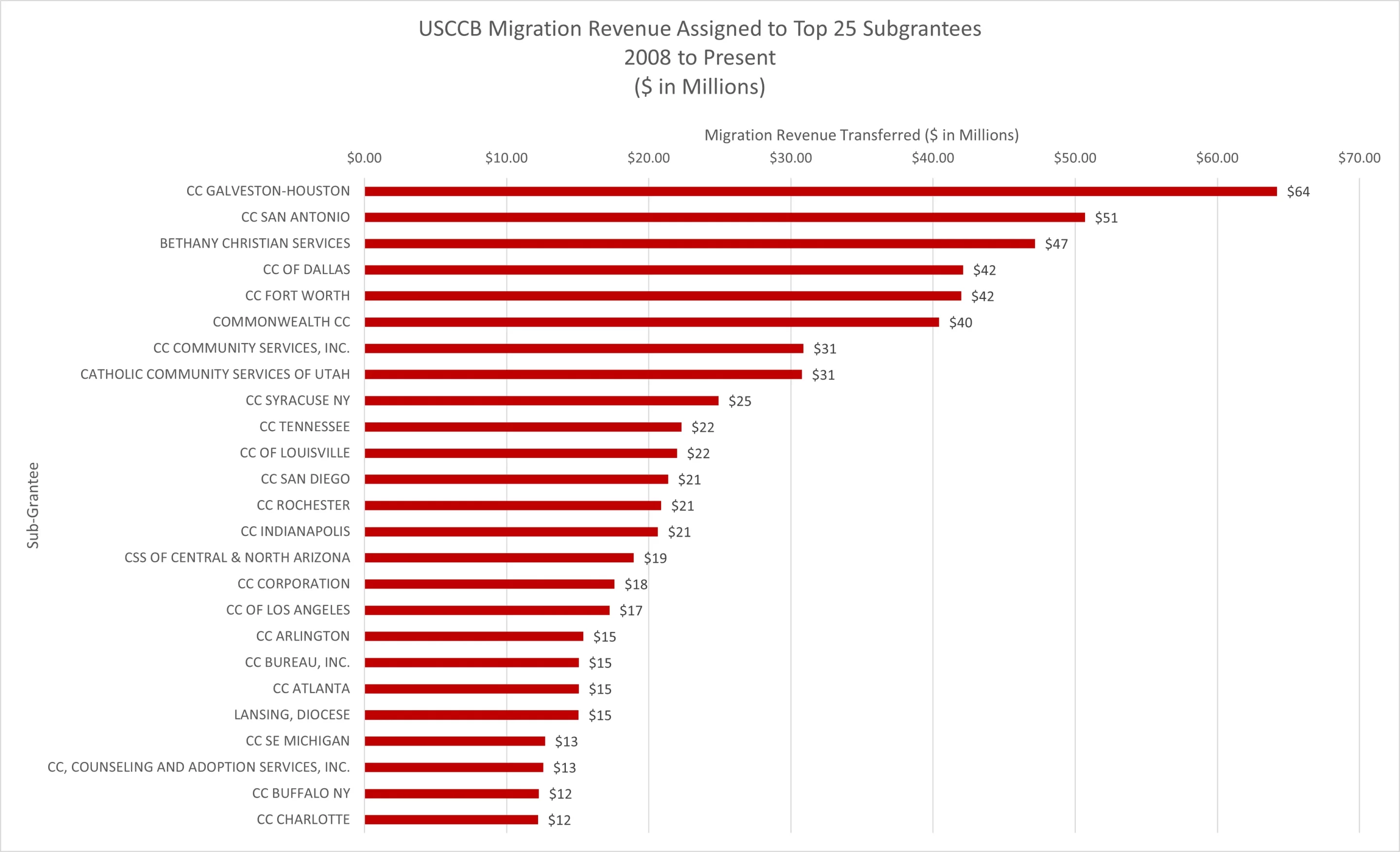

Since 2008, the USCCB has paid out to sub-grantees just over $1 billion. The top 25 beneficiaries of government funds to contribute to the immigration crisis we are in today include the following:

Click here to view all subgrantees benefitting from the USCCB migration grant money from the government from 2008 to the present.

A New Governance Model

Given these findings, one must consider whether the laity should independently govern the financial affairs of the USCCB to preserve the integrity and autonomy of the Catholic Church. Relying on government funds endangers not only the Church’s tax-exempt status but also its mission and credibility. As devout Catholics, we must hold the bishops accountable and champion a return to the Church’s true mission.

The events of the past 15 years have shown that we cannot depend on the bishops to manage this aspect of the Church without both the appearance and reality of government dependence. Can we continue to allow the bishops to lead us down this path? We owe it to the Church to advocate for a new governance model that eliminates financial reliance, ensuring the bishops’ moral and spiritual leadership remains untainted. The future of the Church hangs in the balance.